Real-time analytics can play a crucial role in the fight against financial crime by providing organisations with the ability to detect, prevent, and respond to suspicious activities promptly. Here are several ways real-time analytics can be used in this context:

Transaction Monitoring

Real-time analytics can continuously monitor financial transactions, identifying patterns or anomalies that may indicate fraudulent activities.

Behavioural Analytics

Analyzing historical and real-time data on customer behavior helps establish a baseline for normal activity. Real-time analytics can then identify deviations from this baseline, such as sudden changes in transaction behavior or account access, which may indicate potential fraud.

Machine Learning Models

Utilizing machine learning models in real-time enables the system to learn and adapt to new patterns of financial crime. These models can detect complex, non-linear relationships within data that may be indicative of fraudulent behavior.

Identity Verification

Real-time analytics can be employed for identity verification during account creation, login, or transaction processing. Behavioral biometrics, device fingerprinting, and other advanced techniques can be used to ensure that the user's identity matches historical patterns.

Watchlist Screening

Real-time analytics can screen transactions against watchlists containing information about known criminals, politically exposed persons (PEPs), and sanctioned entities. Immediate alerts can be triggered when a match is found, allowing for swift action.

Geospatial Analysis

Analyzing the geographic locations associated with transactions in real-time can help identify suspicious patterns or locations that are inconsistent with the user's normal behavior..

Geospatial Analysis

Real-time analytics can dynamically assess and update customer risk profiles based on their behavior, transactions, and other relevant factors. This enables organisations to assign appropriate risk scores and allocate resources based on the perceived level of risk.

External Data Sources

Real-time analytics can integrate with external data sources, such as public records, news feeds, and social media, to enrich the analysis and provide additional context for identifying potential financial crimes.

Regulatory Compliance

Real-time analytics helps organisations stay compliant with anti-money laundering (AML) and know your customer (KYC) regulations by continuously monitoring and auditing financial activities.

Technical Foundations

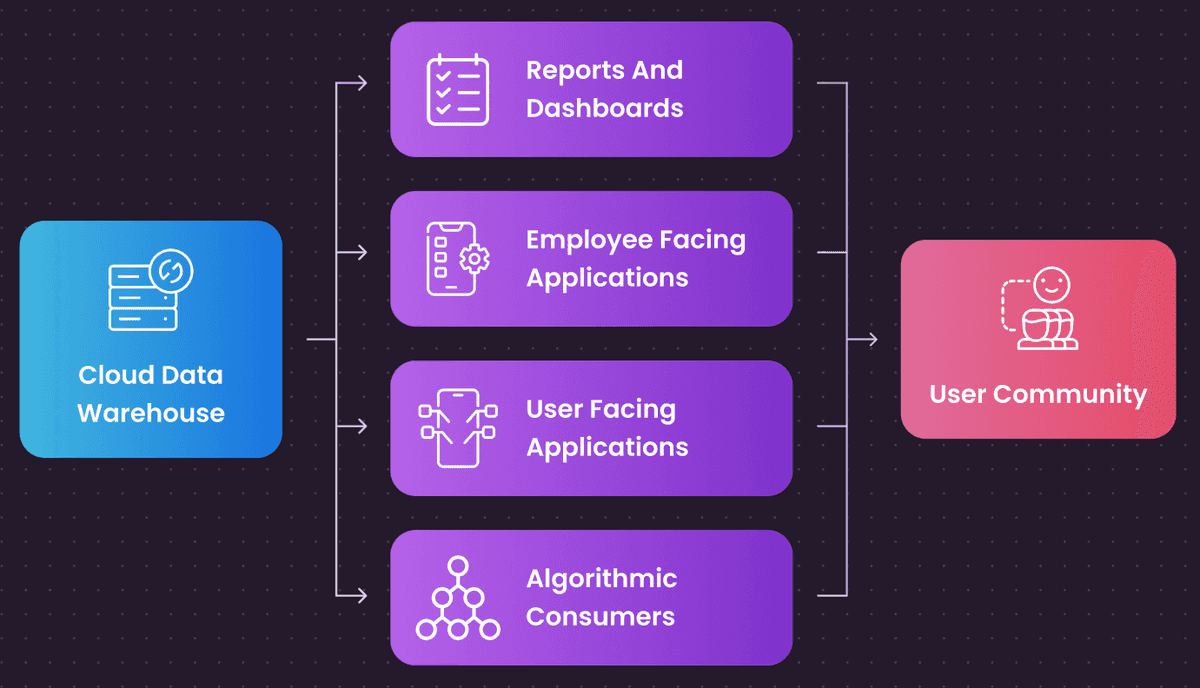

Unfortunately, traditional tools and approaches to data and analytics do not scale to deliver solutions like this.

There are too many delays in the process, and the systems often used are not performant enough to process high volumes of data with low latency. In addition, traditional business intelligence tools are not rich and flexible enough to meet the business demands.

This technology stack needs to be re-invented for the cloud, with tools and architectural patterns that are built for real-time advanced use cases and predictive analytics:

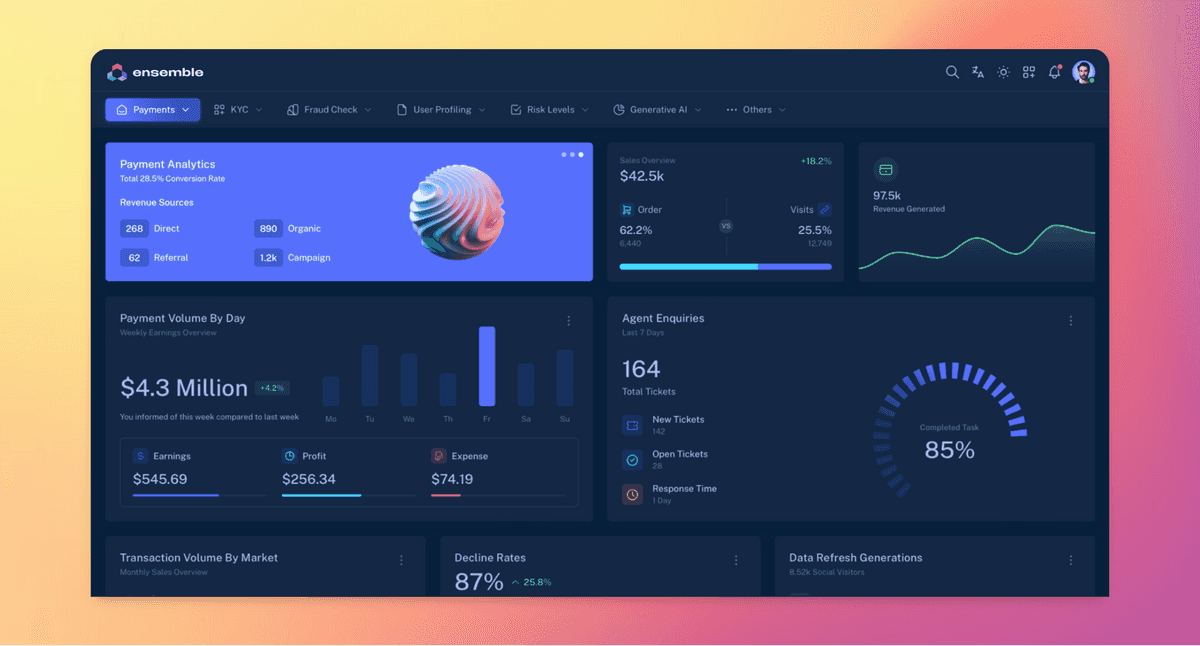

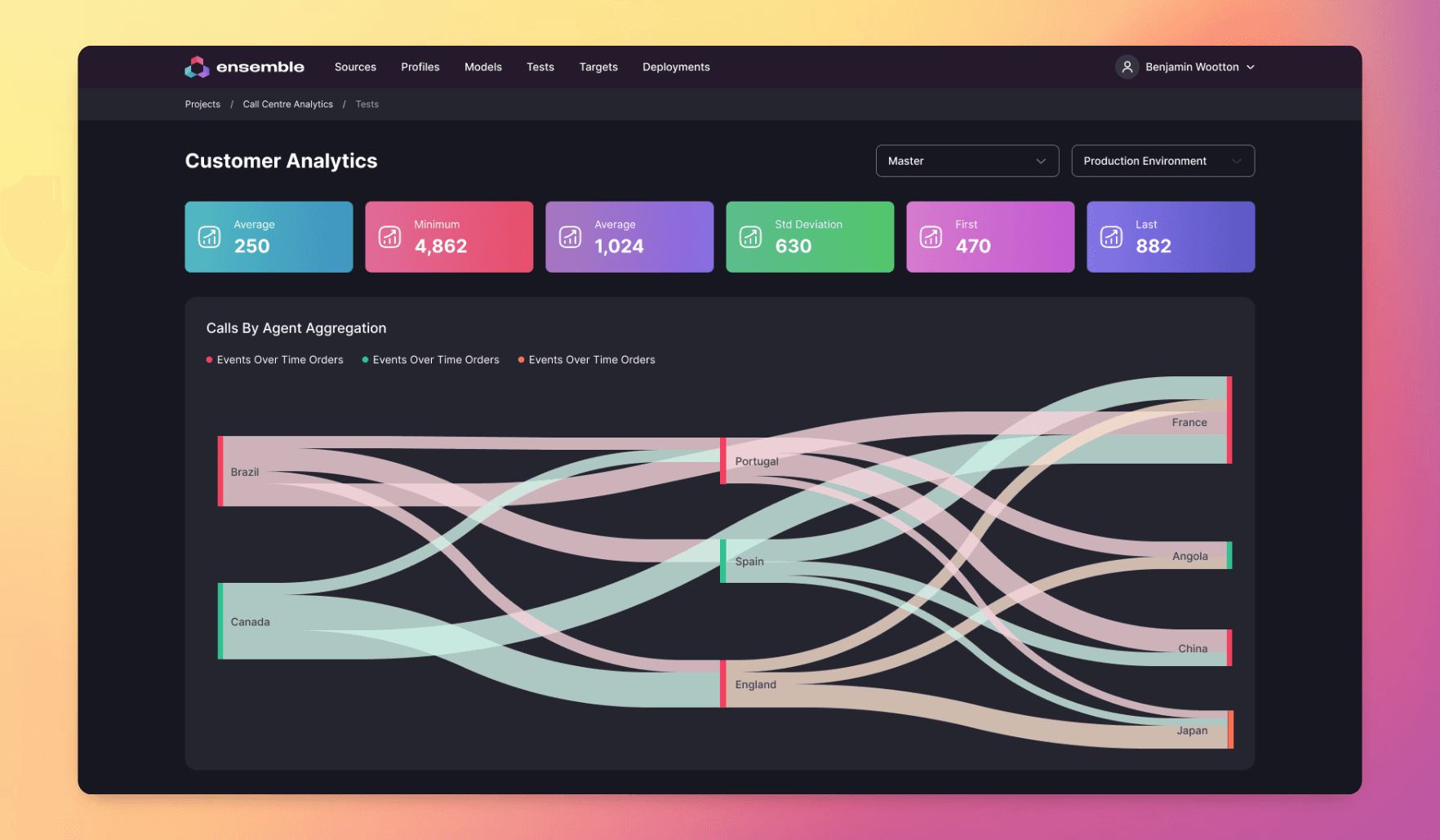

Introducing Ensemble

We are Ensemble, and we help enterprise organisations build and run sophisticated data, analytics and AI systems that drive growth, increase efficiency, enhance their customer experience and reduce risks.

We have a particular focus on ClickHouse, the fastest open-source database in the market, which we believe is the fastest best data platform for systems like this.

Want to learn more? Visit our home page or download our free report that describes the process for implementing advanced analytics in your business.