Real-time analytics play a crucial role in electronic trading by providing traders and financial institutions with immediate insights into market conditions, enabling rapid decision-making and execution of trades. Here's how real-time analytics are commonly used in electronic trading:

Market Data Analysis

Real-time analytics are used to analyze market data feeds, including stock prices, order book updates, trade volumes, and other relevant financial data. Algorithms are employed to identify patterns, trends, and anomalies in the data, helping traders make informed decisions.

Algorithmic Trading Strategies

Electronic trading often involves the use of algorithmic trading strategies that rely on real-time analytics. These algorithms automatically execute trades based on predefined criteria, taking advantage of market inefficiencies or reacting to specific events as they unfold.

Risk Management

Real-time analytics are critical for monitoring and managing risk in electronic trading. Traders and risk managers use analytics tools to assess market exposure, evaluate the impact of potential trades on the portfolio, and implement risk mitigation strategies in real time.

Performance Monitoring

Electronic trading systems need to perform optimally. Real-time analytics help monitor the performance of algorithms and trading infrastructure, identifying any latency issues or bottlenecks. This ensures that trades are executed swiftly and efficiently.

Dynamic Pricing Models

Real-time analytics contribute to the development and adjustment of dynamic pricing models. These models help traders determine optimal pricing for financial instruments based on current market conditions, demand, and other relevant factors.

Market Impact Analysis

Traders use real-time analytics to assess the potential impact of their trades on the market. This includes estimating how their orders might influence liquidity and prices, helping them optimize execution strategies to minimize market impact.

News and Social Media Analysis

Real-time analytics may involve monitoring news and social media feeds to capture sentiment analysis and breaking news that could impact financial markets. This information can be used to adjust trading strategies accordingly.

Order Routing and Execution

Real-time analytics facilitate smart order routing and execution by evaluating multiple execution venues and choosing the best one based on factors such as liquidity, execution speed, and costs.

Regulatory Compliance

Real-time analytics are crucial for ensuring compliance with financial regulations. Electronic trading systems need to monitor trades in real time to detect and report any potential regulatory violations.

Machine Learning and Predictive Analytics

Advanced machine learning algorithms and predictive analytics are increasingly being integrated into electronic trading systems. These technologies analyze historical and real-time data to make predictions about future market movements and optimize trading strategies.

Overall, real-time analytics in electronic trading provide the speed and precision needed to navigate rapidly changing financial markets, optimize trading strategies, and manage risk effectively. It's a critical component in the success of algorithmic and high-frequency trading strategies.

Technical Foundations

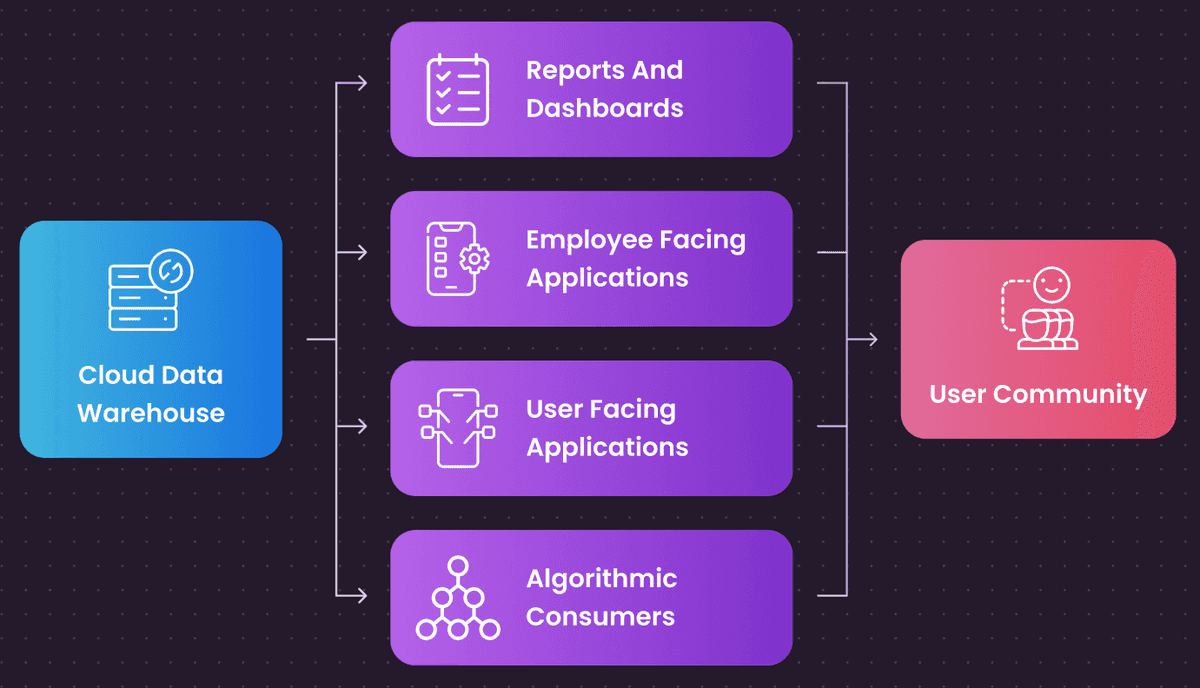

Unfortunately, traditional tools and approaches to data and analytics do not scale to deliver solutions like this.

There are too many delays in the process, and the systems often used are not performant enough to process high volumes of data with low latency. In addition, traditional business intelligence tools are not rich and flexible enough to meet the business demands.

This technology stack needs to be re-invented for the cloud, with tools and architectural patterns that are built for real-time advanced use cases and predictive analytics:

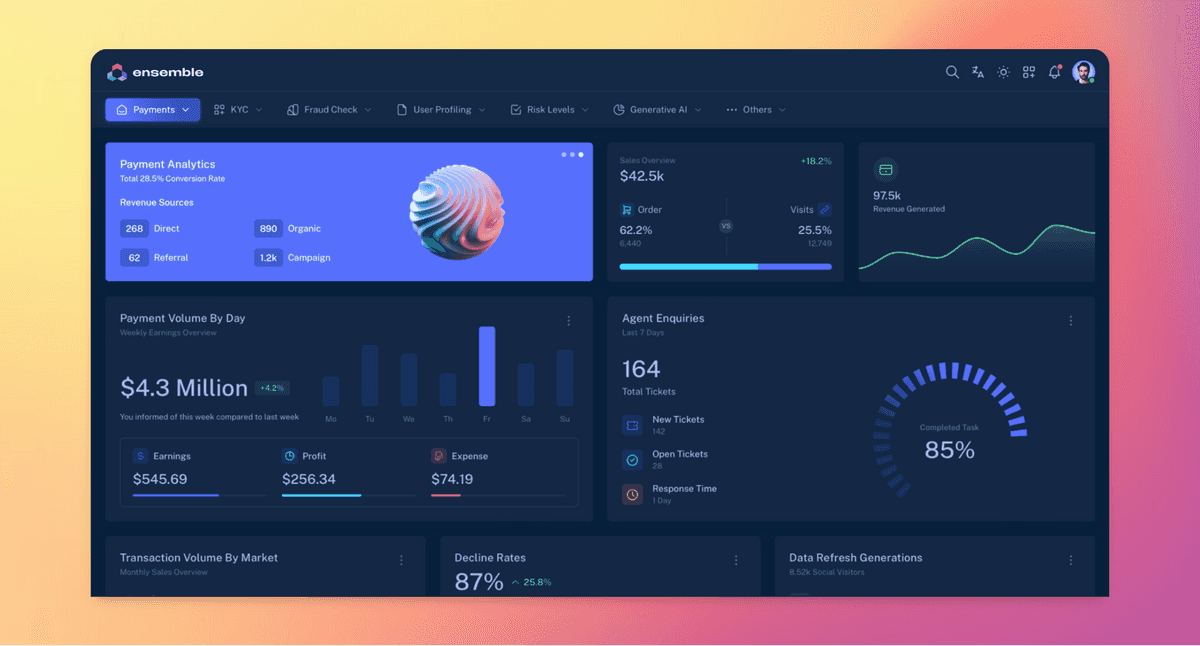

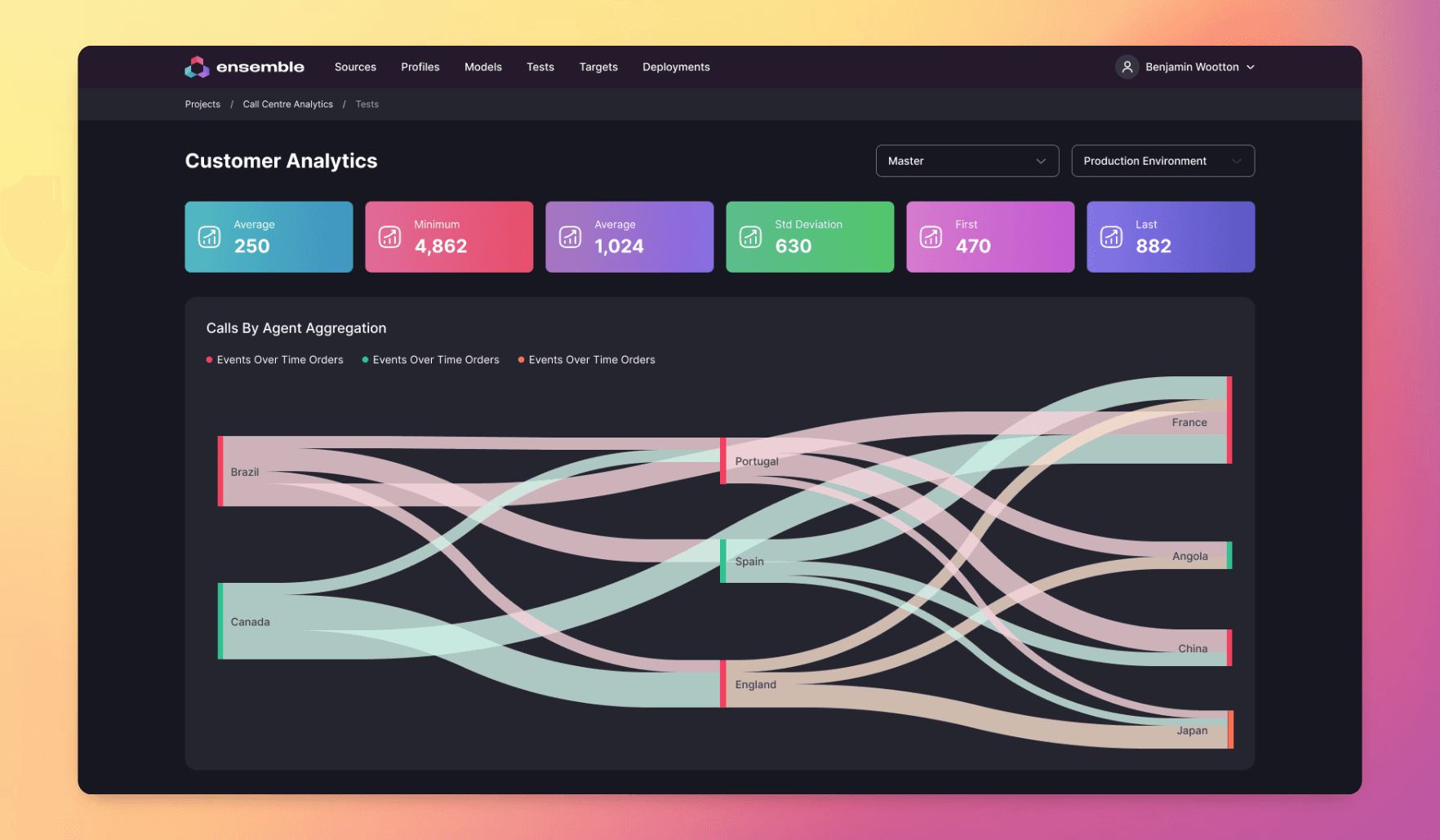

Introducing Ensemble

We are Ensemble, and we help enterprise organisations build and run sophisticated data, analytics and AI systems that drive growth, increase efficiency, enhance their customer experience and reduce risks.

We have a particular focus on ClickHouse, the fastest open-source database in the market, which we believe is the fastest best data platform for systems like this.

Want to learn more? Visit our home page or download our free report that describes the process for implementing advanced analytics in your business.