Real-time analytics is instrumental in credit risk management, allowing financial institutions to assess and manage the creditworthiness of individuals and businesses in real-time. By continuously monitoring and analyzing relevant data, organisations can make more informed decisions, identify potential risks promptly, and adjust credit strategies dynamically. Here are several ways real-time analytics plays a role in credit risk management:

Instant Credit Scoring

Real-time analytics enables instantaneous calculation of credit scores based on the latest financial information and transaction history, allowing lenders to make quick decisions on credit applications.

Dynamic Credit Limits

Utilizes real-time analytics to dynamically adjust credit limits based on changes in a customer's financial situation and transaction patterns, ensuring that credit limits reflect the current risk profile.

Transaction Monitoring

Continuous monitoring of transaction data in real-time helps identify unusual or high-risk transactions, signaling potential credit risks through anomalies in spending patterns.

Behavioral Analytics

Analyzes historical and current customer behavior in real-time to identify patterns indicative of credit risk, including changes in spending habits and late payments.

Fraud Detection

Crucial for detecting fraudulent activities that may impact credit risk, with real-time analytics identifying unusual transaction patterns and unauthorized account access promptly.

Market and Economic Data Analysis

Incorporates market and economic data in real-time to assess the broader financial environment, adjusting credit risk models based on economic indicators and industry trends.

Social Media and Alternative Data Analysis

Includes analysis of alternative data sources such as social media and online behavior in real-time to complement traditional credit scoring models and provide additional insights into creditworthiness.

Credit Portfolio Monitoring

Allows financial institutions to monitor the overall health of their credit portfolios in real-time, identifying concentration risks and assessing the impact of economic changes.

Credit Risk Stress Testing

Facilitates stress testing of credit portfolios under various economic scenarios in real-time, helping organisations assess potential impacts on the credit risk profile.

Regulatory Compliance

Ensures compliance with regulatory requirements through real-time analytics, monitoring adherence to credit policies and generating reports for regulatory authorities.

Customer Communication and Engagement

Enables proactive customer communication through real-time insights, offering personalized credit management advice and engaging with customers to prevent delinquencies.

Early Warning Systems

Contributes to the development of early warning systems that identify potential credit risks before they escalate, enabling preventive measures to mitigate the impact.

By leveraging real-time analytics, financial institutions can enhance their credit risk management strategies, respond promptly to changing market conditions, and make more informed lending decisions. This helps minimize credit losses, optimize risk-adjusted returns, and maintain a healthy credit portfolio.

Technical Foundations

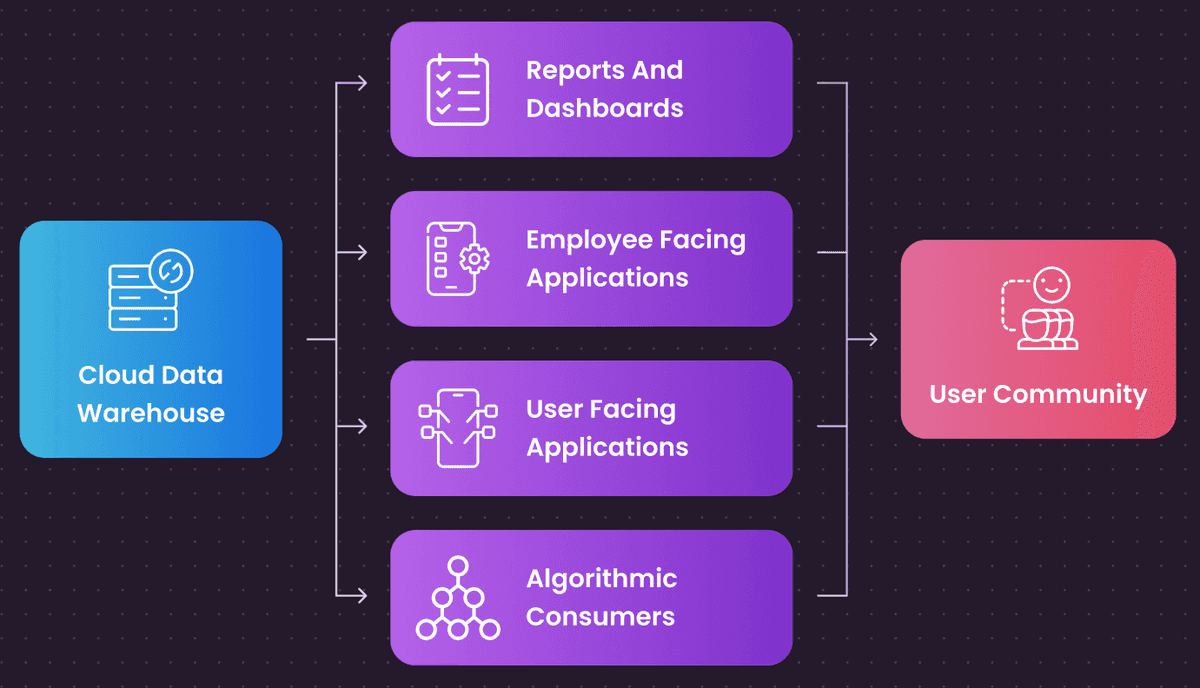

Unfortunately, traditional tools and approaches to data and analytics do not scale to deliver solutions like this.

There are too many delays in the process, and the systems often used are not performant enough to process high volumes of data with low latency. In addition, traditional business intelligence tools are not rich and flexible enough to meet the business demands.

This technology stack needs to be re-invented for the cloud, with tools and architectural patterns that are built for real-time advanced use cases and predictive analytics:

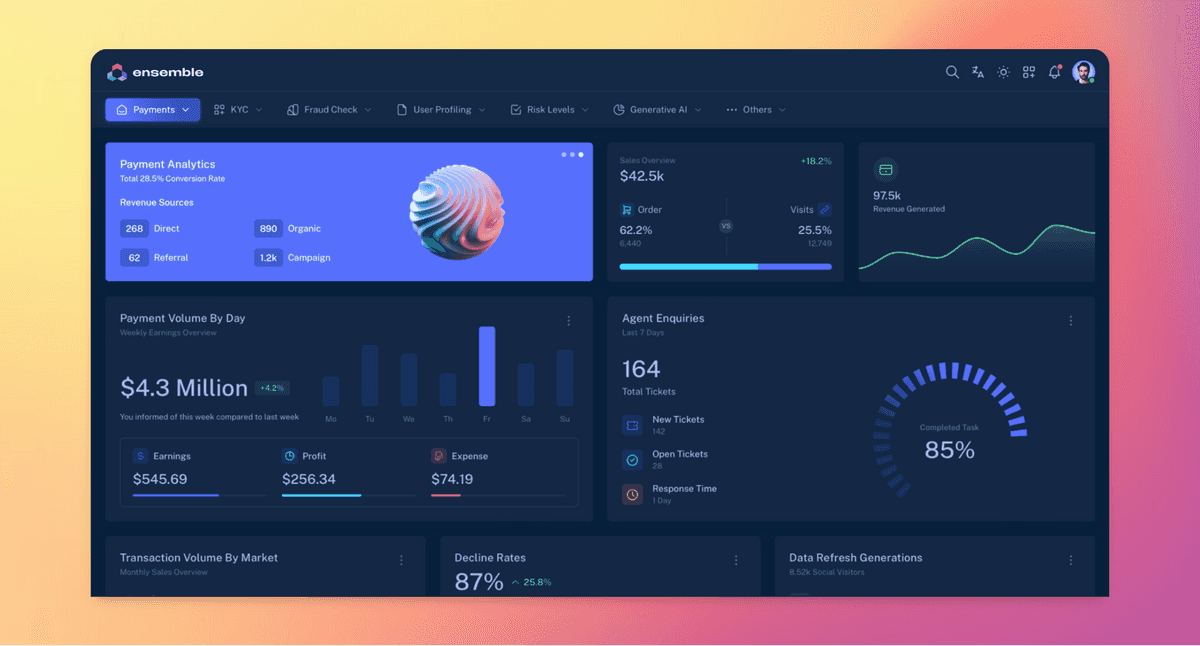

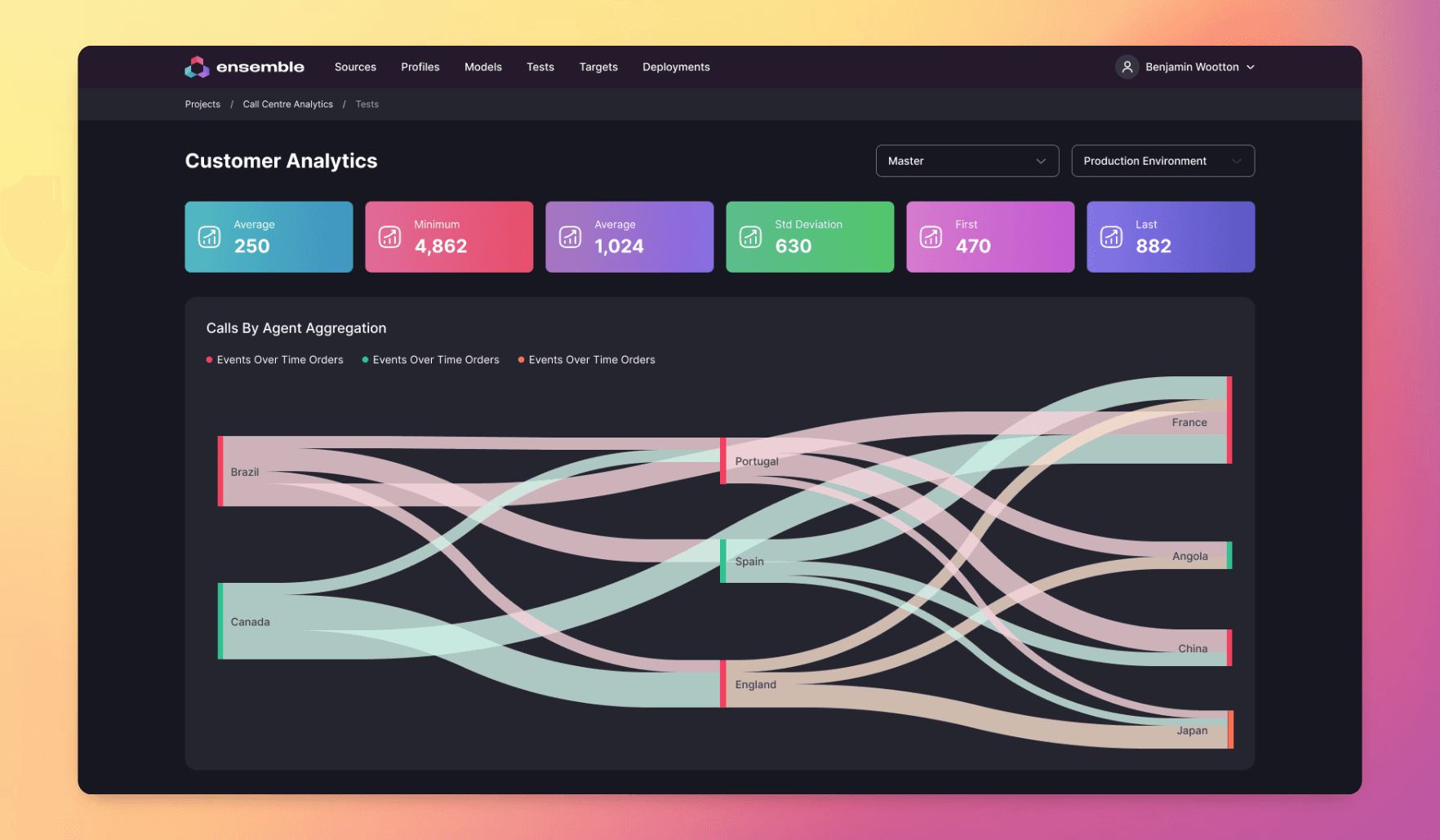

Introducing Ensemble

We are Ensemble, and we help enterprise organisations build and run sophisticated data, analytics and AI systems that drive growth, increase efficiency, enhance their customer experience and reduce risks.

We have a particular focus on ClickHouse, the fastest open-source database in the market, which we believe is the fastest best data platform for systems like this.

Want to learn more? Visit our home page or download our free report that describes the process for implementing advanced analytics in your business.