The crypto industry presents unique challenges stemming from its relative infancy and the decentralized nature of cryptocurrencies.

Regulatory uncertainties and evolving legal frameworks worldwide create an unpredictable environment for crypto businesses, impacting everything from initial coin offerings (ICOs) to crypto exchanges.

The inherent volatility of digital assets adds an additional layer of complexity, requiring participants to manage risks effectively.

Finally, security concerns, such as hacking incidents and vulnerabilities in blockchain technology, also pose continuous challenges, demanding constant innovation to safeguard assets and maintain user trust.

Innovating With Data and AI

Real-time analytics is integral to various aspects of the cryptocurrency industry, providing insights into market dynamics, enhancing security measures, and ensuring compliance with regulations. Whether for trading, security monitoring, or blockchain network optimization, real-time analytics contributes to the efficiency and transparency of the crypto ecosystem.

Example use cases include:

Market Monitoring and Analysis

Real-time analytics is essential for monitoring cryptocurrency markets. Traders and investors can leverage real-time data to track price movements, trading volumes, and market trends. Analytical tools can provide instant insights into market conditions, helping users make informed decisions on buying or selling assets.

Algorithmic Trading

Traders in the crypto industry often employ algorithmic trading strategies. Real-time analytics enables the rapid analysis of market data, facilitating the execution of algorithmic trading algorithms that respond to market changes in real time. This helps optimize trading strategies, manage risk, and capitalize on market opportunities.

Fraud Detection and Security

Real-time analytics is crucial for identifying and preventing fraudulent activities in the crypto space. By monitoring transaction patterns and analyzing user behavior in real time, anomalies and suspicious activities can be quickly detected. This enhances security measures and helps in preventing unauthorized access, hacks, and other fraudulent activities.

Blockchain Analytics

Real-time analytics can be applied to monitor and analyze blockchain transactions. This includes tracking the flow of funds, identifying patterns of use, and assessing the overall health of the blockchain network. This information is valuable for understanding network dynamics, identifying potential issues, and ensuring the integrity of the blockchain.

Wallet Monitoring and Security

Cryptocurrency wallets can be monitored in real time for security purposes. Real-time analytics tools can detect unusual account activities, unauthorized access attempts, or abnormal withdrawal patterns. This enables quick responses to potential security threats, including freezing accounts or implementing additional authentication measures.

Network Scalability and Performance

Real-time analytics aids in monitoring the performance and scalability of blockchain networks. By analyzing metrics related to transaction processing times, block confirmations, and network congestion, developers can optimize the performance of the blockchain, ensuring a smooth and efficient user experience.

Sentiment Analysis

Real-time analytics can be applied to monitor social media, news articles, and forums for sentiment related to specific cryptocurrencies. Sentiment analysis tools can help traders and investors gauge market sentiment, identify potential market movers, and make more informed decisions based on public perception.

Decentralized Finance (DeFi) Analytics

Real-time analytics supports regulatory compliance in the crypto industry. By continuously monitoring transactions and user activities, cryptocurrency exchanges and service providers can ensure compliance with anti-money laundering (AML) and know your customer (KYC) regulations. This helps in preventing illicit activities and maintaining a transparent ecosystem.

Token Analytics

Real-time analytics tools can track the performance and usage of specific tokens. This includes monitoring trading volumes, liquidity, and token-related events. This information is valuable for token issuers, investors, and users participating in token ecosystems.

Technical Foundations

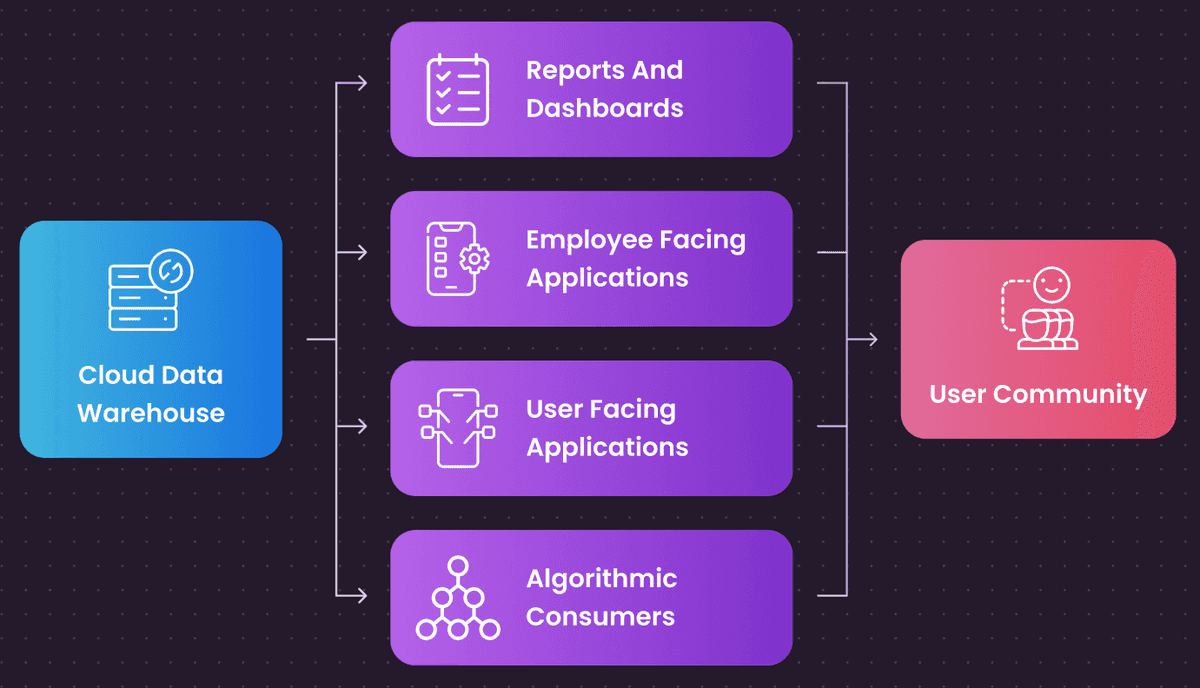

Unfortunately, traditional tools and approaches to data and analytics do not scale to deliver solutions like this.

There are too many delays in the process, and the systems often used are not performant enough to process high volumes of data with low latency. In addition, traditional business intelligence tools are not rich and flexible enough to meet the business demands.

This technology stack needs to be re-invented for the cloud, with tools and architectural patterns that are built for real-time advanced use cases and predictive analytics:

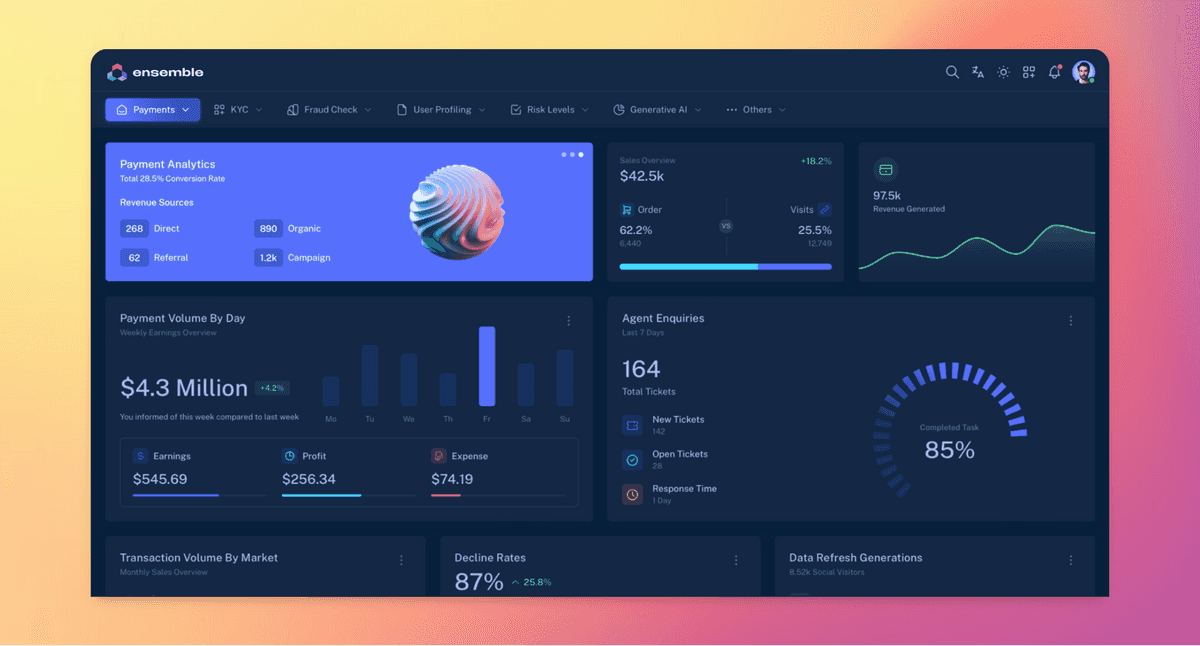

Introducing Ensemble

We are Ensemble, and we help enterprise organisations build and run sophisticated data, analytics and AI systems that drive growth, increase efficiency, enhance their customer experience and reduce risks.

We have a particular focus on ClickHouse, the fastest open-source database in the market, which we believe is the fastest best data platform for systems like this.

Want to learn more? Visit our home page or download our free report that describes the process for implementing advanced analytics in your business.