The capital markets industry is inherently challenging due to its sensitivity to a myriad of external factors, including economic conditions, geopolitical events, and regulatory changes.

Market participants must navigate the complexities of global financial systems and adapt to rapid shifts in investor sentiment. The constant evolution of technology adds another layer of complexity, requiring firms to stay abreast of advancements like algorithmic trading and blockchain.

Innovating With Data and AI

Real-time analytics is a cornerstone of the capital markets industry, providing the tools necessary for efficient trading, risk management, compliance, and decision-making. The ability to analyze and respond to market dynamics in real time is crucial for gaining an edge in this fast-paced and highly competitive industry.

Example use cases include:

Algorithmic Trading

Real-time analytics is fundamental for algorithmic trading strategies. Traders use real-time market data to make split-second decisions on executing buy or sell orders. Advanced algorithms analyze market conditions, identify trends, and optimize trading strategies in real time, allowing for faster and more efficient trading.

Market Surveillance and Compliance

Real-time analytics is essential for monitoring market activities and ensuring compliance with regulatory requirements. Surveillance systems analyze trade data in real time to detect unusual patterns, market manipulation, and other potential violations. This helps regulatory bodies and financial institutions maintain market integrity and comply with legal standards.

Portfolio Management

Real-time analytics aids in risk management by continuously assessing market and portfolio risks. By analyzing real-time market data and monitoring portfolio exposures, financial institutions can identify and manage risks promptly, optimizing their risk-return profile and ensuring stability in the face of market fluctuations.

Liquidity Monitoring

Real-time analytics is crucial for monitoring liquidity in financial markets. Institutions use real-time data to assess market liquidity conditions, identify potential liquidity risks, and make adjustments to trading strategies or portfolios to ensure liquidity requirements are met.

Liquidity Monitoring

Real-time analytics is crucial for monitoring liquidity in financial markets. Institutions use real-time data to assess market liquidity conditions, identify potential liquidity risks, and make adjustments to trading strategies or portfolios to ensure liquidity requirements are met.

Credit Risk Assessment

Real-time analytics enables financial institutions to assess credit risk in real time. By analyzing borrower data, market conditions, and other relevant factors, institutions can make quick and accurate credit decisions, manage credit exposures, and mitigate potential losses.

Fraud Detection and Security

Real-time analytics is employed to detect and prevent fraudulent activities in capital markets. By continuously monitoring transactions and analyzing patterns, anomalies, and user behaviors, institutions can quickly identify and respond to potential security threats, safeguarding the integrity of financial transactions.

Customer Relationship Management

Real-time analytics supports CRM by providing insights into customer behaviors, preferences, and interactions. Financial institutions can use real-time data to personalize customer experiences, offer targeted investment advice, and enhance overall client satisfaction.

Derivatives Pricing and Valuation

Real-time analytics is crucial for pricing and valuing complex financial derivatives. By continuously analyzing market data, interest rates, and other relevant factors, institutions can accurately price and value derivative instruments, facilitating fair and transparent trading.

Market Data Aggregation

Real-time analytics helps in aggregating and analyzing vast amounts of market data from various sources. This includes real-time pricing data, news feeds, and economic indicators. Aggregated data enables institutions to gain a comprehensive view of market conditions and make well-informed decisions.

Implementing real-time analytics in the travel industry requires a robust technological infrastructure, integration of data sources, and a focus on data security and privacy. By leveraging real-time insights, businesses can adapt quickly to changing conditions, deliver personalized experiences, and ultimately enhance customer satisfaction.

Technical Foundations

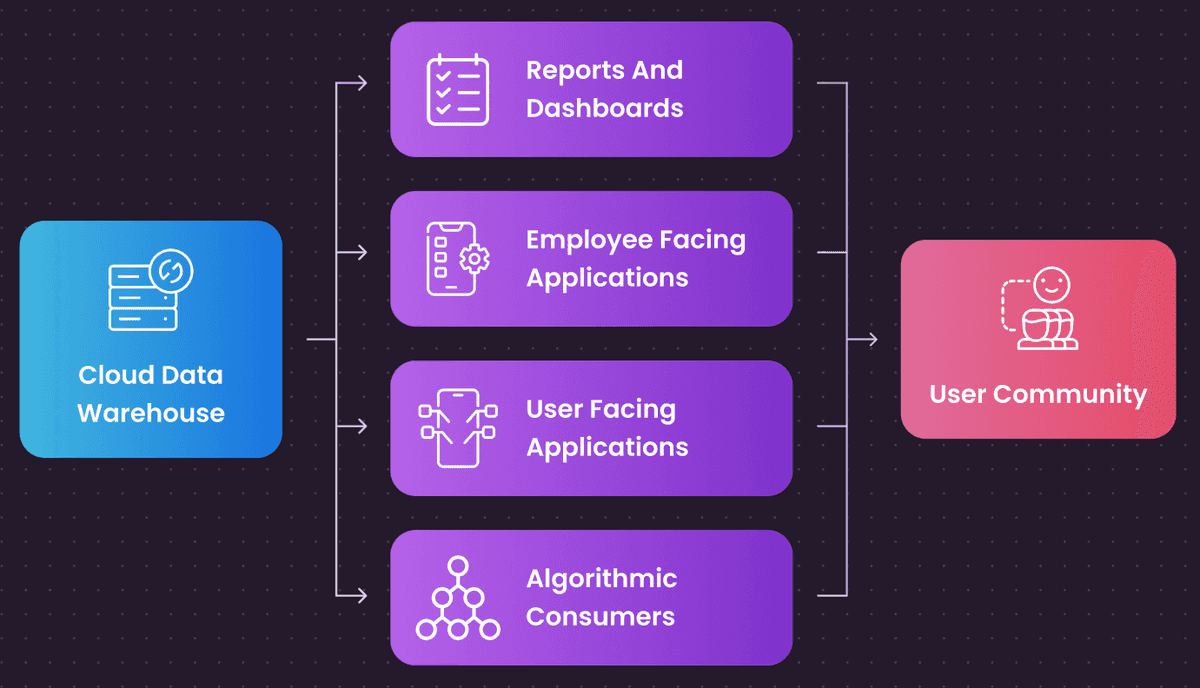

Unfortunately, traditional tools and approaches to data and analytics do not scale to deliver solutions like this.

There are too many delays in the process, and the systems often used are not performant enough to process high volumes of data with low latency. In addition, traditional business intelligence tools are not rich and flexible enough to meet the business demands.

This technology stack needs to be re-invented for the cloud, with tools and architectural patterns that are built for real-time advanced use cases and predictive analytics:

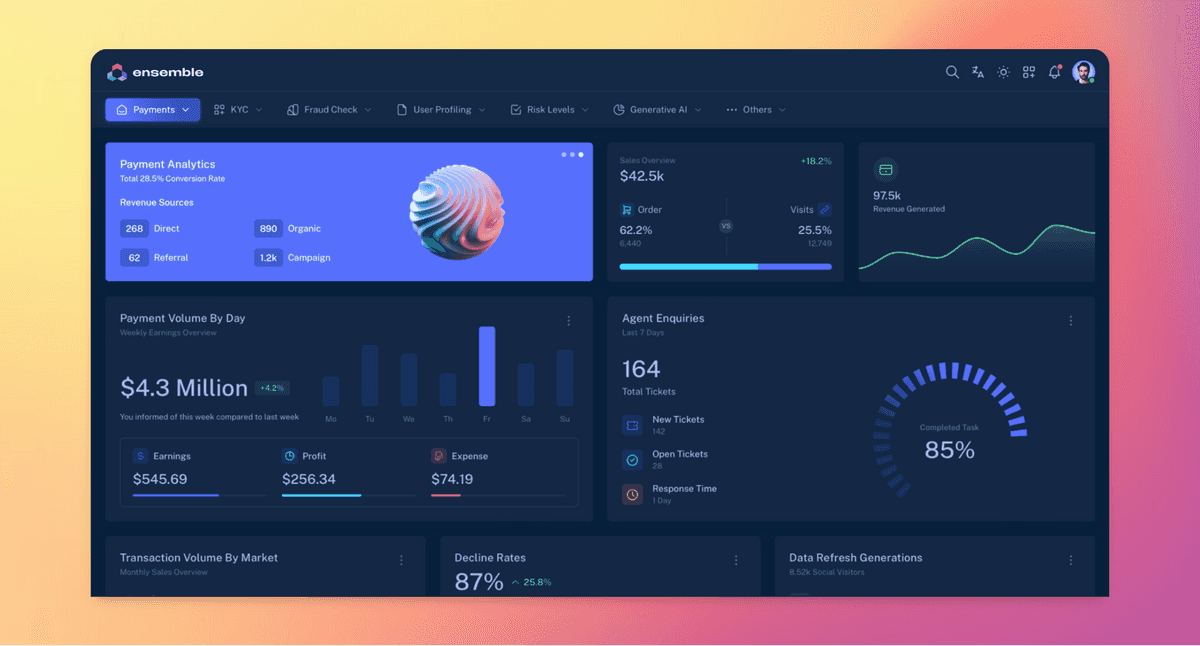

Introducing Ensemble

We are Ensemble, and we help enterprise organisations build and run sophisticated data, analytics and AI systems that drive growth, increase efficiency, enhance their customer experience and reduce risks.

We have a particular focus on ClickHouse, the fastest open-source database in the market, which we believe is the fastest best data platform for systems like this.

Want to learn more? Visit our home page or download our free report that describes the process for implementing advanced analytics in your business.