General

18 Apr 2024

The geopolitical turmoil in recent months is a painful reminder that sanctioned regimes, companies, groups and persons are still able to operate and fund complex international terrorist campaigns.

The US State Department recently confirmed that direct Iranian funding worth $100m per annum is still finding its way to groups such as Hamas and Palestine Islamic Jihad. Whilst it is difficult to know how much non-Iranian financing such groups receive, the US Assistant Secretary for Terrorist Financing and Financial Crimes Elizabeth Rosenberg estimated Hamas’ annual budget alone was $500m.

Rosenberg’s testimony before the Committee of Financial Services Oversight and Investigations in December 2023 followed Binance’s astronomical $3.4bn Fincen and $968m OFAC settlements. Former CEO Changpeng Zhao pleaded guilty to federal charges admitting that the company had failed to meet its legal obligations in the prevention of AML and had acted as a funnel for numerous terrorist groups to receive funds including Al Qaeda.

The Moscow-Tehran-Pyongyang alliance continues to collaborate, though steps have been taken to deprive its financial institutions of the oxygen they require to operate. Most notably, we have seen continued use of sectoral sanctions and European Union’s Council Regulation instruction to SWIFT to remove Russian banks from its member payment network in 2022 following the Ukraine crisis.

Many countries have introduced robust AML programs and regulated financial entities are scrutinised and inspected regularly.

For instance, the UK was an early responder to this challenge introducing the year 2000 Terrorist Act which provided government agencies with robust powers of investigation. The British Money Laundering framework is one of the most comprehensive in the world and continues to evolve and adapt its legislation since the 2017 money laundering, terrorist financing, and transfer of funds regulations were originally passed.

Yet despite this legislative and regulatory backdrop, the United Nations still report up to €1.87tn is successfully launded each year. It is important to examine some of the reasons that contribute to this exorbitant figure (equal to that of the annual South Korean economy) and how new technology can be applied to combat terrorist financing and money laundering more effectively.

As a result of regulatory changes and interventions, terrorist groups need to continually evolve their methods of funding and look to exploit vulnerable gaps in AML detection technology that is typically used by financial institutions.

This is typically achieved by first gaining a working knowledge of the systems that are in place and their control parameters.

Once this understanding has been established by the perpetrators, it is then harnessed, refined and implemented through a variety of money laundering scenarios. These include familiar scenarios such as ‘layering’, ‘structuring’ ‘circular payments’ and ‘cash payments'.

In addition to these, newer threats posed by DLT, high value goods, real estate, charities, phone farms, mules and trade based money laundering are also exploited by the criminals.

This leaves financial institutions in a constant game of cat and mouse as they try to keep up with new techniques and new tools.

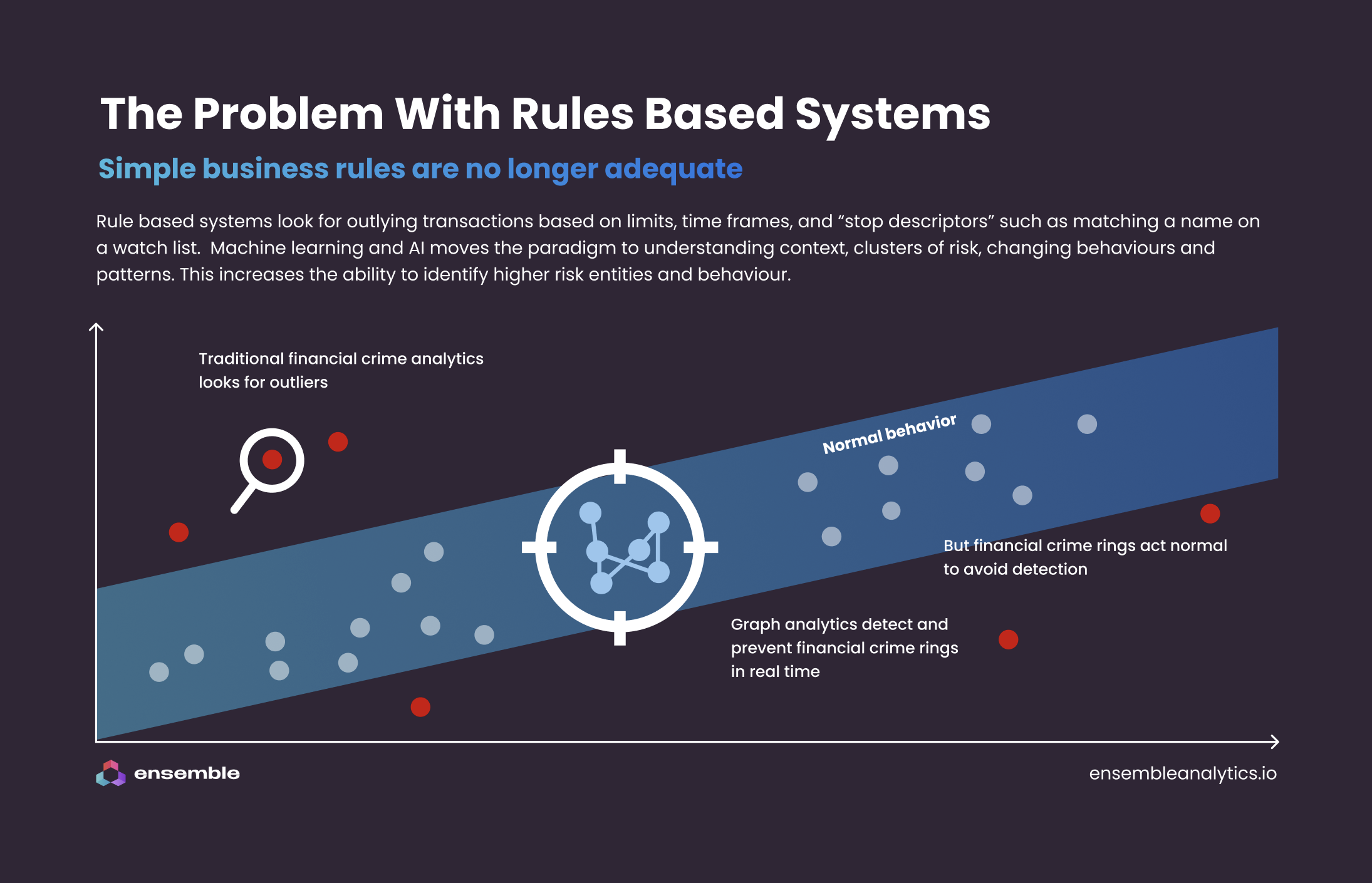

The problem is that the technology used to combat money laundering is not sophisticated enough.

Traditional methods of detecting money laundering relied on static data, rules and the skills of a well trained analyst.

Whilst these methods will undoubtedly continue as a foundation for combating financial crime they are prone to exploitation once criminals and terrorists alike understand the predetermined set boundaries that these systems operate within.

What is needed is much more intelligent systems that takes into account the connections between entities, and monitor the full context of the transaction in order to detect the subtle differences between something which is an legitimate transaction or potentially an indicator of money laundering or terrorist financing.

Compliance analysts are often working long hours dealing with multiple data silos, manual investigations at both the transactional and entity resolution level in addition to clearing thousands of false positives each day.

Statista reported in the US alone the number of Compliance officers has increased from 204,000 in 2010 to 359,640 in 2022. This increase in hiring and scaling compliance teams is in part attributed to the amount of manual work analysts face on a day to day basis.

This growth in the amount of manual work and the human resources required to execute it is simply not sustainable in todays digital economy.

On the 27th of March 2024 the US Department of Treasury published its report on Managing Artificial Intelligence-Specific Cybersecurity Risks in the Financial Sector. The report as clear: “Artificial intelligence is redefining cybersecurity and fraud in the financial services sector”.

The report specifically referenced the gap in expertise between large financial institutions that have their own AI resource and small to mid size firms that lack the resources to train large language models and general shortage in marketplace talent.

A new trend has emerged, leading AI firms like Ensemble are working closely with Chief Risk Officers to deliver meaningful and impacting AI based technology that addresses the specific gaps in existing compliance platforms.

This collaborative approach means that technology and compliance teams alike can evolve and confidently detect and prevent threats posed from criminal and terrorist networks.

Applying advanced analytics, machine learning and AI to Transaction Monitoring allows analysts to detect risk otherwise missed by rules based systems. This type of detection allows for the rapid analysis of thousands of data points from both internal and external sources revealing links and patterns of behaviour that identify criminal and terrorist based money laundering.

AI though is not simply limited to transactional analysis and false positive reduction. It can also play a vital part in reducing manual analyst work for example the extraction of data points from company registries when performing corporate due diligence or on letters of credit and bills of lading in trade finance.

Indeed its application can be used across the entire customer life cycle from identification through to perpetual KYC monitoring and risk assessment. Copilots also part of the journey, they can be designed to provide assisted decision making presenting data in a meaningful way removing hours of manual work. They also provide governance across the AML-CDD process by helping to ensure an analyst adheres to each Financial Institution's procedures can report in real time on the status of any compliance case or action.

AI will become the most important single technology at the disposal of a Chief Risk Officer in tackling serious financial crime, terrorist financing, money laundering and fraud. It is crucial that those risk officers have access to the right technical expertise advice to remain compliant and avoid the devastating financial and reputational damage as seen by Binance.

We help financial crime teams and risk officers understand how AI and machine learning enhance their overall compliance programmes.

This includes identifying the specific use cases that will deliver tangible and cost effective benefits, and then the technology and data strategies which need to be put into place to help them identify more situations of interest whilst reducing false positives.

Our value is in helping businessess evolve their technology to meet the demands of both new regulations and the changing threats of financial criminals. We do this without wholesale replacement of existing transaction monitoring systems, instead augmenting them with advanced analytics that close gaps which are hard to detect with traditional vendor and SaaS systems.

If you would like to learn more about how AI can potentially be applied to combat financial crime, please sign up to our webinar on May 11th at 11pm BST where we will explain how Advanced Analytics and Machine Leaerning can be used for financial crime detection and compliance: