General

6 Apr 2020

Those wanting to commit serious financial crime or violate sanctions programs will continue to use methods we are all familiar with.

For example, traditional techniques such as the layering of transactions, smurfing (breaking down large amounts of money into smaller, less suspicious amounts), and utilizing complex offshore ownership structures remain prevalent.

Though these are by no menameanss trivial to combat, they are relatively well understood by now and there are a number of technical solutions to monitor for these situations of interest.

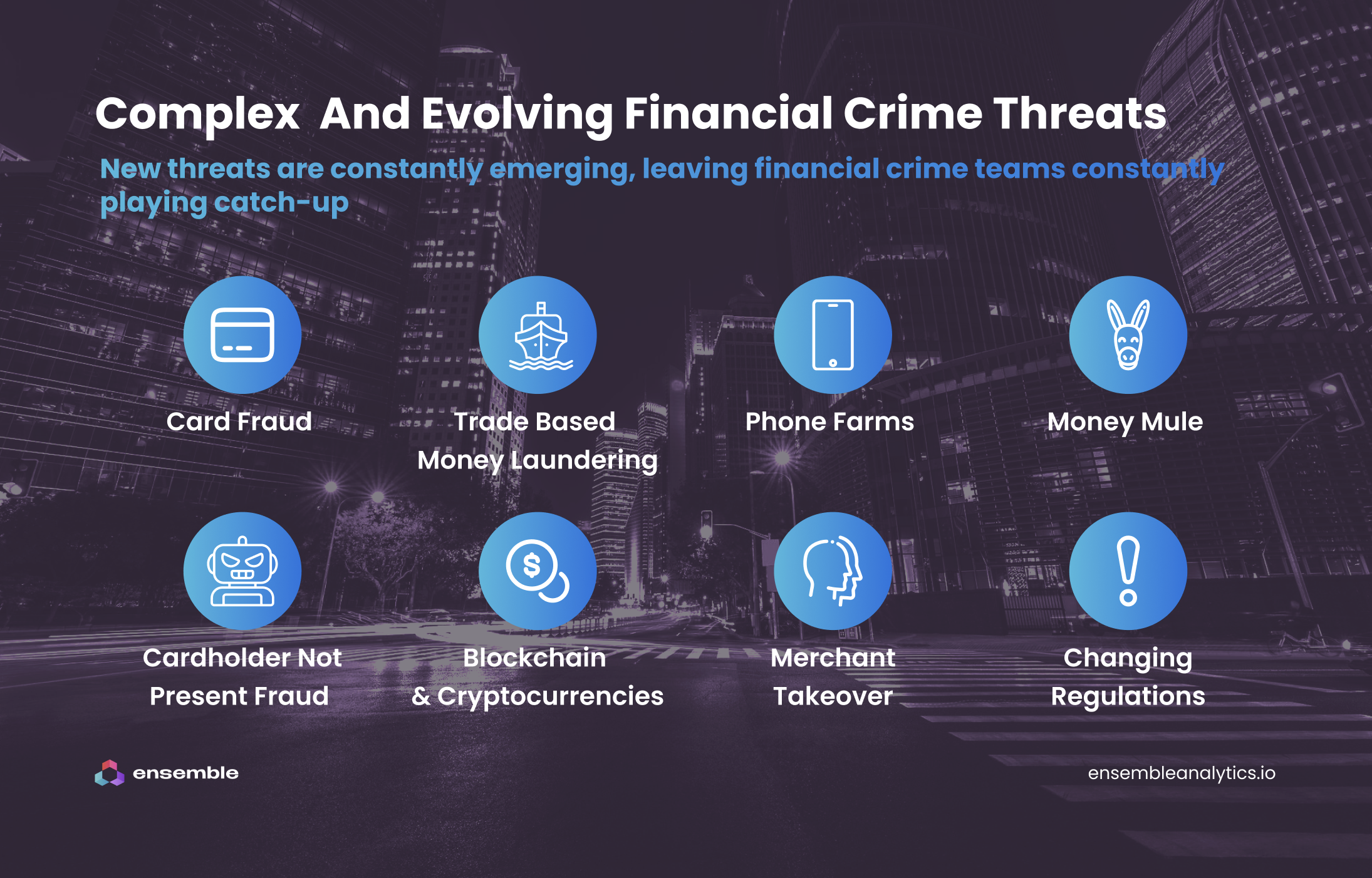

Criminals however are not standing still. They are becoming more sophisticated, constantly trying new ways to commit crime and identify vulnerabilities in financial crime programmes. This leaves financial crime teams playing catch-up and doing so using the same level of human resources.

Examples of scames and crimes which have come to light in recent years include:

These evolving strategies reflect a blend of technical innovation and psychological manipulation, aiming to stay one step ahead of regulatory and security measures.

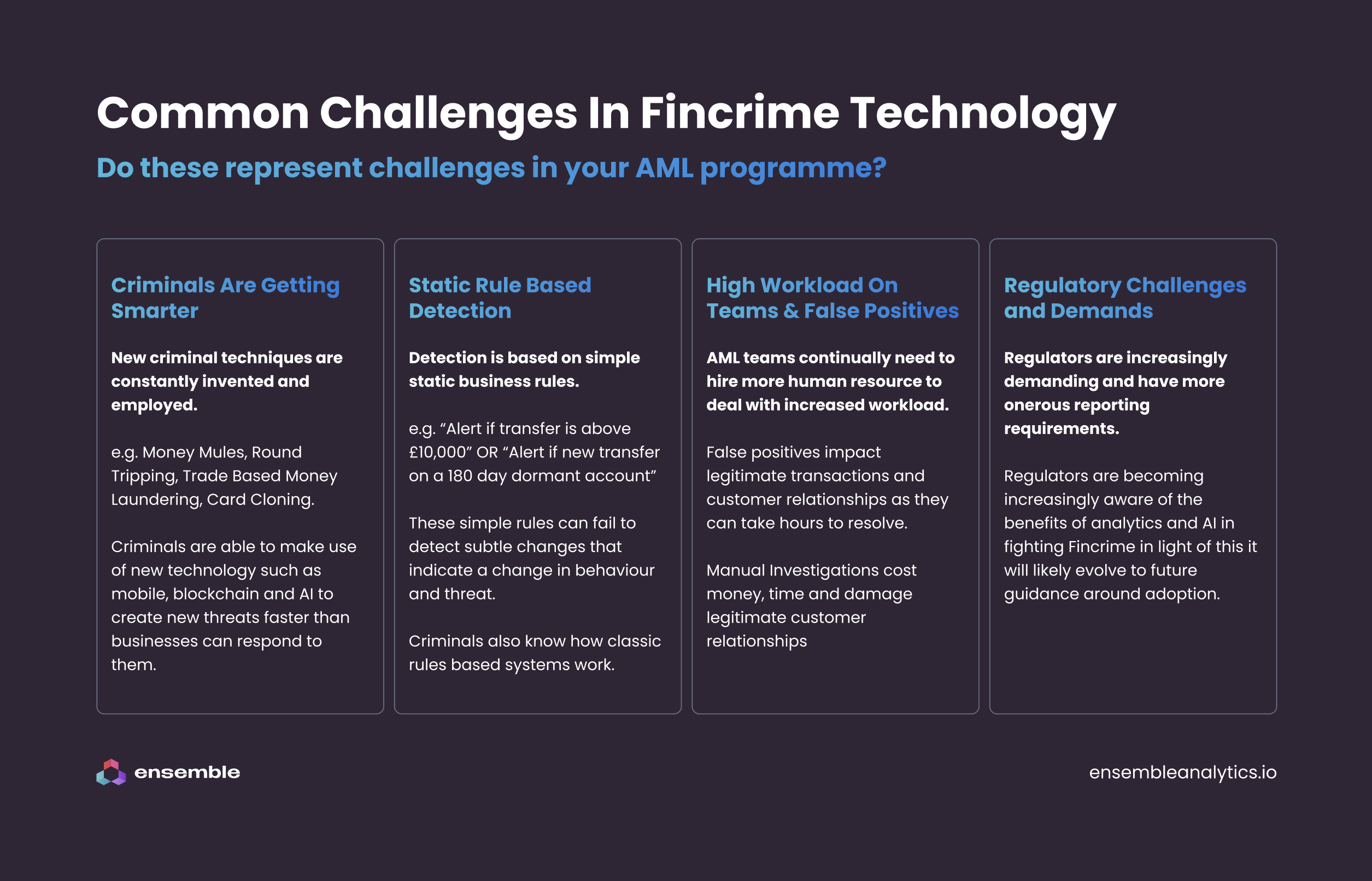

The response from the financial sector must be equally innovative and dynamic. Payment institutions, cryptocurrency companies, and traditional banks are increasingly turning to cutting-edge technology to bolster their defenses against this evolving threat landscape. Machine learning algorithms, blockchain analysis, and behavioral biometrics are among the tools being deployed to detect suspicious activities more effectively.

Businesses will typically implement lots of systems to combat these, but we believe that the existing systems are not fit for purpose.

However, the challenge lies not only in identifying genuine risks but also in maintaining a delicate balance that avoids unduly restricting legitimate customers' ability to conduct transactions. Overly aggressive security measures can lead to false positives, eroding customer trust and satisfaction.