General

Using Advanced Analytics To Overcome Challenges In Financial Crime Technology

15 Mar 2024

It is estimated that more than 50% of businesses have been a victim of financial crime, with total global losses amounting to a remarkable $1.4 trillion.

In response to this, businesses spend vast sums across both technology and manpower in the fight against financial crime and in meeting the associated regulatory and compliance requirements such as anti money laundering and KYC.

Data and analytics are at the heart of this world. For instance, businesses will typically implement transaction monitoring and trade surveillance systems to alert when suspicious activities are identified, and implement KYC and KYB type systems which connect to third party databases to check for creditworthiness, ultimate beneficial ownership and sanctions.

These systems need to be relatively real-time and deal with high volumes of data, meaning that they tend to be some of the more advanced use cases for analytics in production today.

There is however potential to take this further - to use data, analytics and AI in more sophisticated ways to detect more situations of interest, to reduce false positives and reduce the amount of manual effort.

By stepping up their level of sophistication and implementing these techniques, businesses can protect themselves to a much greater degree whilst dramatically lowering their compliance costs. For many businesses, this could be a multi-million dollar business case.

In this blog, the first in a series, we wanted to explain what we see as the current landscape and challenges in the financial crime and compliance technology world, and explain why they are such high value problems to solve. In future articles, we will get into more technical depth on how we think better analytics and AI can move the needle.

Criminals Are Becoming Increasingly Sophisticated

As fast as businesses improve their capabilities for financial crime detection, criminals devise new attacks and step up their capabilities in a never ending game of one-upmanship.

The methods and tactics used by fraudsters are often devised by well educated, experienced individuals and groups that have spent years analysing data from people, events, transactions and interactions within banking and digital platforms to detect and exploit weaknesses.

These groups invest heavily in methods to avoid detection and can exploit new technologies such as AI or Blockchain faster than institutions can respond to the new threats.

This all means that legitimate businesses constantly have to raise their game - implementing better systems with more sophisticated analytics and more rigorous review processes simply to stand still.

Regulations Become More Stringent

Businesses need to adhere to evolving and diverse regulatory standards across different jurisdictions, and the obligation for businesses to report financial crimes to regulatory authorities are also becoming increasingly stringent.

This leads to new requirements in client onboarding processes and periodic review protocols, which in turn require new and more advanced risk scoring models.

This adds up to constant effort and change for compliance teams as they are effectively faced with a moving target.

There Are Increasing Demands On Financial Crime Teams

The evolving nature of financial crime and the demands of new regulation mean that each year businesses are asking more and more from the same compliance teams.

Scaling teams by adding more humans is not sustainable in the long term, and even if we were to throw more people at the problem, it takes time to hire, nurture and develop talent to the point in which they can be operational and effective.

Whilst automation has reduced data processing times e.g. screening for sanctions and politically exposed people, the actual work of identifying higher risk behaviours across account opening, transactional history and periodic review is still largely manual. This translates to a high and growing manpower cost.

Rules Based Systems Are Inadequate

Many financial crime monitoring systems are based on simple rules, where a business will configure alerts in response to simple static situations. These rules are often setup once at the outset of the system implementation and are rarely reviewed or changed.

The problem is that this rule based approach is not flexible enough considering the diverse and changing nature of customers and their behaviours.

For example, as a customer begins to earn a higher salary, it is likely that they will spend more each month, or if they frequently travel to another country it is more likely that they will remit money there. Most rules based systems cannot account for these behavioural attributes and how usage profiles change over time.

What is needed is more intelligent and behavioural based analytics which take into account individual usage patterns that change over time.

The move to this 'contextual risk decisioning' ie before the actual crime has been committed could help to protect customers, company reputation and save analysts hundreds of hours in manual data gathering and analysis.

Limited Use Of Machine Learning And AI

Related to the above, we see few financial crime teams and vendors venturing into the more advanced areas such as machine learning and AI.

Machine learning allows you to infer relationships from your data to identify patterns which you would never proactively configure in a rules based system, whilst AI techniques such as large language models can help you to integrate unstructured text data and documents into your automated risk management engines. Though these techniques are complex to implement, they represent enormous untapped potential.

The few organisations who are beginning to experiment with AI such as the greenfield fintechs have started to see the rewards in automating manual processes and detecting hidden risks buried amongst thousands of lines of data that surround a client interaction.

Legacy Or Siloed Technology

Another common situation is that companies are working with siloed systems, meaning that analysts have to consult multiple systems across AML, KYC and KYB platforms.

This increases the case handling time and increases the potential for human error. This also makes it difficult to join up signals from across these various systems.

How Can Advanced Analytics Help?

The only viable answer to solving these challenges is with more intelligent automation.

Ideally, we should be aspiring to maximise straight through processing, identifying only the specific situations that require human review whilst reducing false positives.

When a human review is required we need to make the job of the financial crime analyst as efficient and effective as possible, arming them with the information they need to quickly make the right risk based decision.

To achieve all of this requires more sophisticated use of analytics. We need to process incoming data in real-time and continuously, apply data science and machine learning to the streams of data to identify the situations that matter, and take advantage of AI techniques such as large language models to aid this process from the front to back.

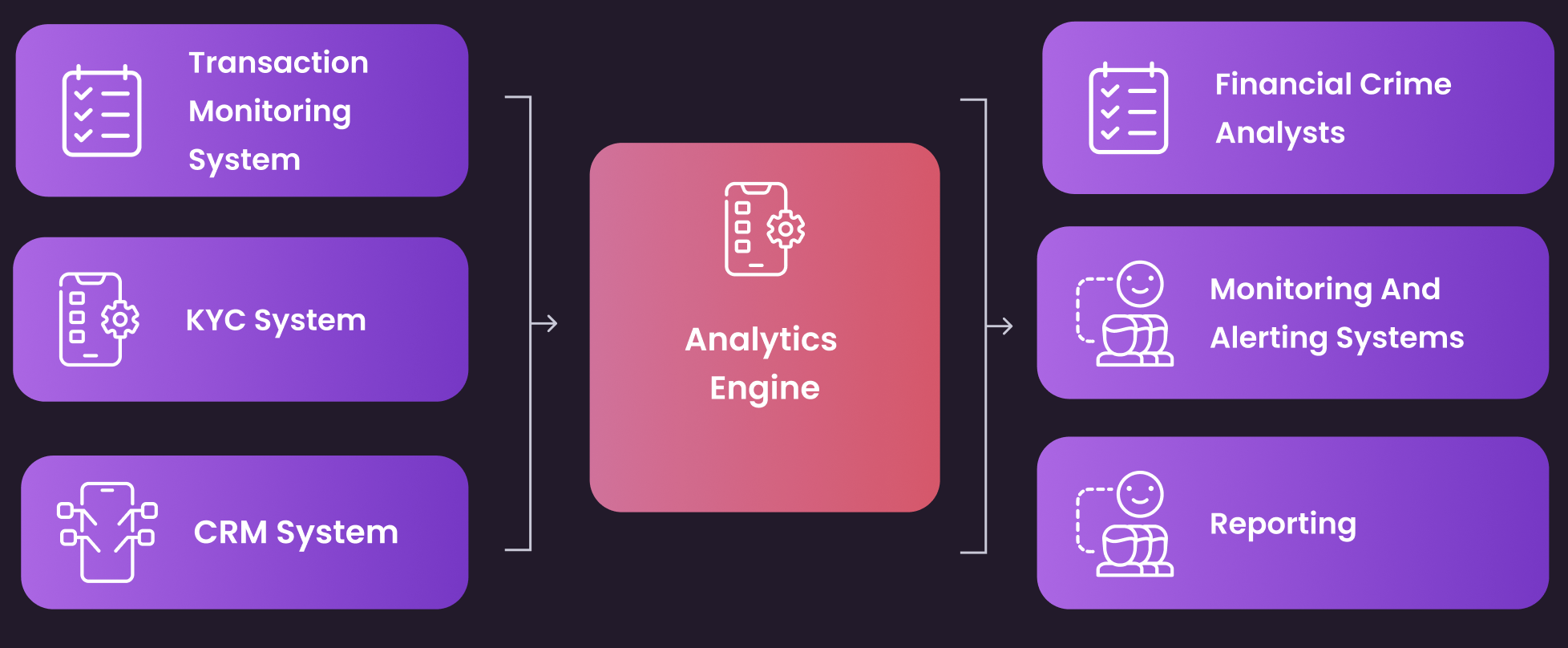

For us, this is not about replacing existing monitoring systems. Instead, we need to analyse the data within them and augment them with more advanced analytics. These can be relatively simple and non disruptive projects to deploy which can have an outsized impact.

In future blogs, we will get more into the technical patterns and data science approaches that we see. For now, we are interested in learning from any practitioners in this space about their highest impact challenges they are facing in this area.

How We Help

At Ensemble AI, we help financial crime teams and risk officers understand how AI and machine learning enhance their overall compliance programmes.

This includes identifying the specific use cases that will deliver tangible and cost effective benefits, and then the technology and data strategies which need to be put into place to help them identify more situations of interest whilst reducing false positives.

Our value is in helping businessess evolve their technology to meet the demands of both new regulations and the changing threats of financial criminals. We do this without wholesale replacement of existing transaction monitoring systems, instead augmenting them with advanced analytics that close gaps which are hard to detect with traditional vendor and SaaS systems.

Join Our Webinar To Learn More

If you would like to learn more about how AI can potentially be applied to combat financial crime, please sign up to our webinar on May 11th at 11pm BST where we will explain how Advanced Analytics and Machine Leaerning can be used for financial crime detection and compliance: